How to Invest in Basketball Cards: A Beginner’s Guide (UPDATED 2024)

This article was originally published on my Medium blog in 2021. The present article is an updated version that includes additional information and reflects new developments in the hobby.

Disclaimers:

this article contains affiliate links for Amazon and eBay. Any purchases you make after clicking on these links may net me a small commission at no additional cost to you.

I am not a financial advisor and this article is not financial advice. Do your own due diligence and only invest what you can afford to lose.

Introduction

NBA basketball cards have been around since 1948, but they’ve never been hotter than they are now.

…Well, almost.

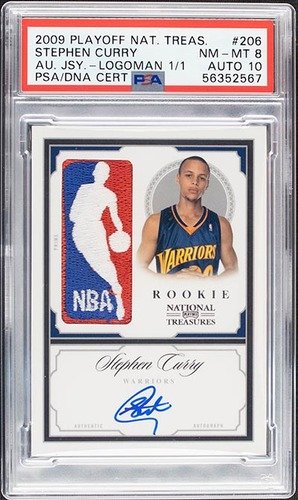

If we wanna be pedantic, the trading card hobby really peaked a few years ago. A confluence of factors — perhaps spearheaded by the covid-19 pandemic — saw the sports card market explode in 2021. In February 2021, a Luka Doncic rookie card sold for $4.6 million, then the highest price ever fetched for a basketball card. Just two months later, a LeBron James rookie card snatched the crown away in a historic $5.2 million sale, tying the previous record set by a 1952 Mickey Mantle card for the most expensive sports card ever. Oh, but we’re not done yet: just two months later, a Steph Curry rookie card dethroned the King in a staggering $5.9 million sale. All in all, the top 27 most expensive sports card sales of all time have taken place from 2020 to 2022.

A Stephen Curry 1/1 National Treasures Logoman RPA sold for $5.9 million in July 2021. Image via Beckett.

Things have cooled off a bit since then. As of this writing, no basketball card sale in 2024 has eclipsed the $1 million mark. Prices across the spectrum of value have dropped.

Does that mean the bubble has burst? Maybe. But does that mean the hobby is in a bad place? Absolutely not. According to Yahoo! Finance, the sports card market is expected to grow by $6.71 billion from 2021 to 2026.

The pandemic boom was an obviously unsustainable market anomaly that inflated prices and brought in a bunch of get-rich-quick pump-and-dumpers. But it also brought in countless genuine hobbyists — hobbyists who’ve stuck around and contributed to a thriving market that continues to grow at a healthy rate. And given the post-boom market correction, there’s no better buying time than now for an alternative asset class that has proven it’s here to stay.

If you’re a complete newbie looking to dip your toes into the exciting world of basketball cards — whether to turn a profit or perhaps just to indulge in the thrill of collecting — this article has you covered.

Before we start: a quick note on investing vs. collecting

With interest in sports cards soaring, the past couple of years have seen a massive influx of newcomers to the hobby looking to make a quick buck.

Unsurprisingly, not every veteran in the card game is happy with this sudden surge in popularity. As the number of hobbyists entering the space with a purely money-making mindset have risen, so have the grumblings of disillusioned old heads despairing at the diminishing appreciation for the heart and soul of the hobby.

Basketball cards are — first and foremost — collectibles designed to be enjoyed in their own right. For decades, passionate NBA fans have collected and traded while sparing little thought for profit. These people found fulfilment in the hobby itself: the satisfaction of adding to one’s personal collection of favorite players; the excitement of pulling a rare, numbered parallel from a retail fat pack. They found gratification in the little things that make trading cards so popular to begin with.

I won’t lie: I came into the hobby because of the money. But I stayed because I loved basketball, and I quickly grew to love the little things about card collecting. My hope is that any beginner reading this article will come to adopt this mindset as well. There’s nothing wrong with looking to make money in this hobby (indeed, that’s what this article is about), but I promise you that you won’t be here long if that’s all you care about. Collecting and investing aren’t mutually incompatible; learn to love both!

So without further ado, let’s get right into it!

Basketball Card Brands

In the early days of the hobby, several companies — including Topps, Bowman, Fleer and Upper Deck — manufactured basketball cards. Starting in 2009, however, Panini America obtained exclusive rights to produce NBA trading cards and is today the mother company behind dozens of different brands (though they’ll be ceding their license to Fanatics come 2026). Certain unlicensed companies also create cards featuring NBA players (e.g., Onyx, Leaf) with the caveat that they cannot feature NBA-branded imagery.

Due to the sheer number of these brands, it can be a daunting task for beginners to figure out what to buy. Luckily, these brands vary tremendously in price, allowing fledgling collectors and investors to narrow down their options based on budget.

Though far from an exhaustive list, here are some of the most popular brands, broadly categorized into low-, middle- and high-end tiers:

Low-end

NBA Hoops (the first NBA set of the year, featuring [usually] the first cards of rookie players in their NBA uniform)

Donruss

NBA Hoops 2022-23 blaster box. Image via Amazon.

Middle-end

Prizm (widely considered to be the most popular modern set)

Mosaic

Optic

Select

Revolution

Prizm 2022-23 blaster box. Image via Amazon.

High-end

National Treasures

Immaculate

Flawless

Eminence

National Treasures 2021-22 hobby box. Image via eBay.

Yearly sets for each brand are released sequentially throughout the NBA season, with lower end brands generally coming first. Panini also produces several college sets prior to their NBA releases, but these cards typically fail to hold value long-term.

Cardboard Connection keeps a handy calendar to keep track of release dates.

Basketball Card Products, Card Types and Set Lists

Basketball products are split into what are known as retail and hobby boxes. Retail boxes, as the name implies, are sold at big box retailers like Walmart and Target, while hobby boxes can only be found at your local card shop, online at sites like Blowout Cards or Panini’s official website, or secondary marketplaces like eBay.

The cards found inside these products can be split into the following types:

Base set: generic player cards, including rookies, denoted by a unique number.

Parallels: differently colored/patterned variations of base set cards, the rarest of which are denoted by a serial number (e.g. a parallel labelled /49 means that only 49 copies of that card were produced. Serial numbers can be as low as 1/1, meaning that that card is the only one of its kind in existence).

Inserts: themed cards distinct from the base set. These cards can also come in serial numbered parallels.

Short Prints (SP) and Super Short Prints (SSP): parallels or inserts with limited print runs. Technically, SPs and SSPs are unnumbered, making their exact print run unknown, but many sellers will advertise numbered parallels as SPs/SSPs.

Autographs: cards autographed by the featured player. These cards are often serial numbered and may also come in parallels. Autographs may either be sticker autos (i.e., the player signs a transparent sticker that is then stuck on the card) or on-card autos (i.e. the player signs directly on the card); the latter are almost always more highly sought-after.

Memorabilia: cards containing a patch of the player’s jersey (or sometimes a piece of a shoe), often game-worn. Patches featuring the NBA logo are known as a Logoman, and are generally the most sought-after. These cards are usually serial numbered and may also come in parallels.

Besides being sold in different places, retail and hobby boxes differ in the types of cards that can be found inside. While both carry the same base set, hobby boxes offer better odds for hits (rare cards) and contain guaranteed autograph and/or memorabilia cards. Both retail and hobby boxes contain exclusive parallels and inserts that cannot be found in its counterpart product. Moreover, while low- to mid-end brands are available in both retail and hobby format, high-end brands like National Treasures come exclusively in hobby boxes.

For comprehensive overviews of every available card in a set, including information on unnumbered SPs and SSPs, refer to set checklists by Beckett or Cardboard Connection (here’s one for 2020–21 Donruss).

Donruss 2020–21 LaMelo Ball base card (left) vs. yellow and green holo laser (right). Laser parallels were exclusive to Donruss 2020–21 hobby boxes. Images via SportsCardInvestor.

Retail boxes are further broken down into the following products, in ascending size order:

Gravity packs: small packs of 4–8 cards

Fat packs: larger packs of around 30 cards; exclusive to low-end brands

Cello packs: several gravity packs wrapped in cellophane packaging

Hanger boxes: small box including either one large pack or several gravity packs

Blaster boxes: medium box of gravity packs

Mega boxes: large box of gravity packs

Hobby boxes are less varied, typically issued in just a standard hobby box and, for some brands, a 1st-off-the-line (FOTL) hobby box. FOTL boxes, first introduced by Panini in 2017, are a limited early release available exclusively online at Panini’s official website. Aside from allowing collectors early access to new sets, FOTL boxes offer exclusive parallels and more guaranteed hits.

If you’re really rolling in dough, you can also buy cases — giant boxes of multiple hobby boxes allocated to distributors and wholesalers. Many sets contain SSP cards that are seeded one in every case. These are called case hits and, as you can imagine, are very valuable.

Determining Basketball Card Value & Tracking the Market

So what determines a card’s value in the eyes of collectors? Let’s break it down.

Rookie card

All other factors held equal, cards released during a player’s rookie year are almost always the most valuable.

Rarity

As with any collectible, rarity is highly valued. With basketball cards, this can be easily ascertained thanks to serial numbers.

Patches & autos

Cards with jersey patches and player autographs are both highly sought after. The holy grail for most basketball card collectors are rookie patch autos (or RPAs), which feature both a patch and an autograph on a single rookie card. The record-breaking Stephen Curry card that sold for $5.9 million was a one-of-one Logoman RPA from National Treasures.

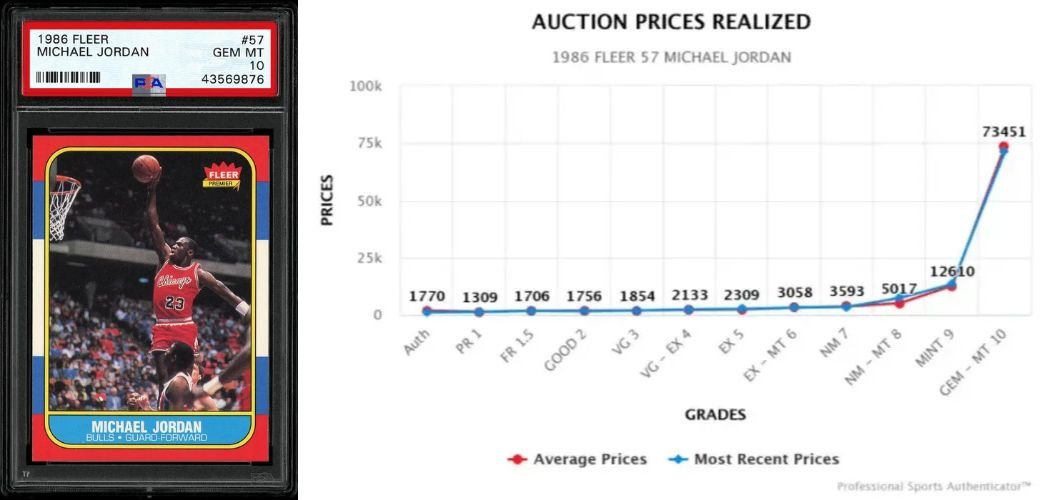

Condition / grade

Card condition is another extremely important determinant of value. Because condition is often in the eye of the beholder, collectors look to professional grading companies to act as an objective arbiter of condition and thus value (I’ll go into more detail on grading later). Gem mint (graded 10) cards will fetch significantly higher prices than even a graded 9 card, especially for vintage cards.

There are lots of grading companies out there, with Professional Sports Authenticator (PSA), Beckett Grading Services (BGS) and Sportscard Guaranty Corporation (SGC) — in that order — generally considered to be the most reputable. The following graph depicts auction sales for graded 1986 Fleer Michael Jordan cards (colloquially known as “slabs”) — perhaps the most iconic basketball card of all time — at each PSA grade.

Price graph of graded 1986 Fleer Michael Jordan rookie cards. Images via PSA. Shop this card on eBay.

In addition to specifying grades, grading companies also maintain publicly available records of the number of each grade they’ve awarded to any given card, known as a population report. Highly-graded cards with a low pop count (i.e. more rare) will generally fetch higher prices.

Player performance, health & accolades

Much like how stock prices reflect the success of a company, basketball card prices usually reflect a player’s performance. Naturally, a star player will garner more demand than a 15th man. But if a star player starts to slump — or, worse yet, gets injured — expect his value to decline. On the flip side, if a rotation player starts showing glimpses of breaking out, his value will rise.

Austin Reaves’ rookie cards spiked in value following his surprising breakout with the Lakers late in the 2022-23 season and during the 2023 FIBA World Cup. Image via SportsCardsPro. Shop this card on eBay.

Accolades, hype and team success are all factors that also play into a player’s card value. Winning one of the league’s major annual awards (Most Valuable Player, Most Improved Player, etc.) is almost guaranteed to spike a player’s prices, at least in the short-term. And if you’re bullish on a lowly-seeded team’s chances to make some noise in the playoffs on the backs of their underrated superstar, it might not be a bad idea to invest in his cards early before everyone else catches on.

This is where it pays — literally — to be a fan of the game. If you’ve got a good pulse on the league and a sharp intuition for these kinds of things, there’s a lot of money to be made.

Legacy, popularity & cultural significance

A great player will almost always fetch higher prices than a no-name, but greatness alone does not guarantee massive long-term growth in value; popularity matters too.

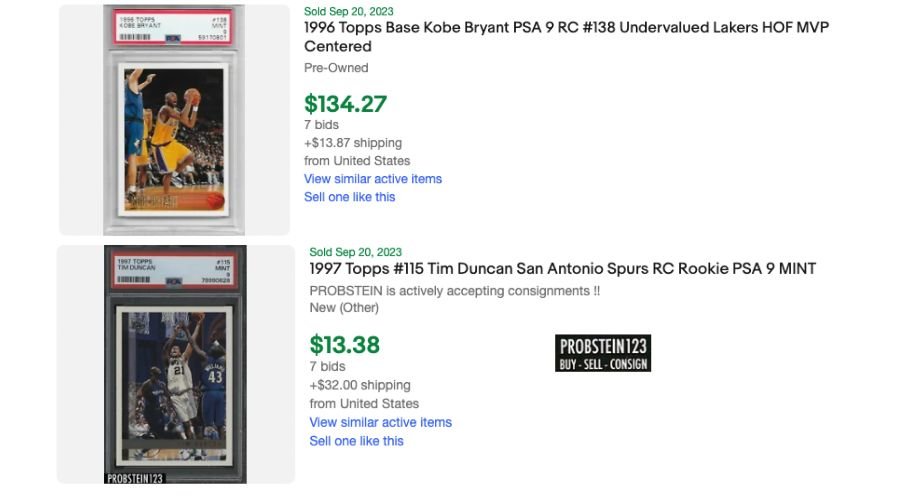

To illustrate this point, let’s take a look at Kobe Bryant. Most basketball purists wouldn’t include the Black Mamba in their top 5 greatest players of all time. But if I were to hedge my bets on any player’s cards to retain and grow in value long-term, I wouldn’t take anyone except maybe Jordan and LeBron over Kobe.

That’s because very few other legends hold a candle to the Mamba in terms of cultural significance. Everyone and their grandma has heard of Kobe Bryant. Multiple generations grew up yelling “Kobe!” when tossing trash into the bin. Especially in the aftermath of his passing, Kobe is revered and adored in a way that almost no other superstar even comes close to — and his card prices will reflect that.

On the flip side, take someone like Tim Duncan: a well-respected, well-liked all-time great who many would even rank above Kobe, but who’s also just… kinda boring? With all due respect to arguably the greatest power forward of all time, Duncan simply hasn’t penetrated the cultural zeitgeist in the way Kobe has — and his card prices reflect that.

Bar some kind of unprecedented scandal, all signs point towards LeBron James leaving behind a similar legacy to Kobe. Michael Jordan, of course, is self-explanatory. After them, I’d single out Stephen Curry as the only other player with transcendent cultural significance; “Curry!” is the new “Kobe!”, after all. Finally, I wouldn’t underestimate the demand of alternative markets: in China (which is a huge and rapidly growing market for sports cards), Yao Ming is as relevant as Kobe and Jordan, and perhaps significantly more so than LeBron. In a similar vein, I would argue that guys like Hakeem, Mutombo and Embiid are great investments for the potential influx of African collectors over the next few decades.

Release timing

The basketball card market is volatile, and no one can truly predict where prices are going to go. However, there are some general cyclical trends that you can follow if you’re looking to liquidate your investments sooner rather than later.

Firstly, prices tend to dip in the offseason and peak during the playoffs.

Secondly, college sets tend to dip in value after the first NBA sets are released, which in turn dip in value when more expensive sets are released later on in the year. In practice, then, if you pull a slick parallel from a college set, you’d likely make the most money selling it before NBA Hoops is released that year. Likewise, you’d be best off flipping your Hoops rookie cards before Prizm comes out.

Tracking the market

The easiest way to determine the current value of a card is to simply search for it on eBay (“set name and year”, “player”, “card number”, “parallel”/“serial number”/“patch”/“auto” [if applicable]) and filter by “Sold Items” or “Completed Items”. To see accepted Best Offer prices that eBay doesn’t make public, check out 130point. eBay sold listings (or “comps”) are the most common reference point and hobby standard when negotiating deals.

If you’d like to view prices over time, check out SportsCardPro for free sales charts. For more comprehensive data, Sports Card Investor offers a paid service called Market Movers.

Basketball Card Investment Strategies

Now that we have a solid grasp of what drives value, what should you be doing if your primary goal is to turn a profit in this hobby?

Well, let’s first talk about what you shouldn’t be doing: buying and ripping boxes in hopes of landing big hits (this includes participating in breaks). That’s gambling, not investing.

This was especially the case when I wrote the first edition of this article in 2021 amidst the sports card boom. The frenzied demand for basketball cards at the time led to a massive influx of scalpers entering the hobby looking to make a quick buck by flipping sealed product. These opportunists camped outside of Targets and Walmarts overnight, clearing shelves and re-selling product at up to 4x manufacture suggested retail price (MSRP). Almost invariably, anyone who bought boxes from scalpers at the time lost money, even with the inflated secondary market for singles.

Those times are (for the most part) behind us, but just because you can now find boxes at reasonable prices doesn’t mean you should be buying and ripping them regularly. The inherent nature of the collectible industry is that, more often than not, you will lose money doing so.

Of course, that doesn’t mean you shouldn’t do it at all. The best part of the hobby is pulling hits from a pack. Indulge yourself in that experience every now and then; just don’t make it your primary strategy if you’re looking to make money.

In my eyes, then, smart basketball card investment strategies fall broadly into long-term and short-term categories. The former is akin to throwing money into an index fund while the latter is more analogous to stock trading.

Long-term strategies:

• Investing in sealed wax

So long as we aren’t in another junk wax era of sports cards, buying and holding onto unopened boxes (known as “wax” in hobby parlance) should be a relatively safe long-term investment. Since most people tend to rip boxes as soon as they get them, supply will gradually diminish over time, driving their value up (conversely, the passage of time may actually decrease the value of unnumbered cards as more enter the market over time).

When choosing boxes, try to focus on years with strong rookie classes — 2003 (LeBron) or 2018 (Luka), for example. Scarcity aside, the potential value of what may be inside is the primary driver of its value. For example, while the price of a sealed 2003 Topps Chrome hobby box may seem exorbitantly high right now, it’s actually only a fraction of the price of its top chase card: the LeBron James Gold Refractor numbered out of /50, which last sold for $900,000 in a PSA 10.

But therein lies the main downside to this strategy: fighting the collector’s (or pehaps gambler’s) itch to rip those boxes yourself. If will-power and delayed gratification are strong suits of yours, though, I’d definitely recommend picking up a few boxes and setting them aside for a few years (or even decades).

• Investing in the GOATs

In my mind, there are three players whose cards have close-to guaranteed potential for long-term growth: Michael Jordan, LeBron James and Kobe Bryant. No one else comes close in terms of player calibre, cultural significance and popularity. If you have the capital at hand, there’s very little reason you shouldn’t pick up a graded 2003 Topps Chrome LeBron James and set it aside for a few decades; it’s as safe an investment as there is in the basketball card world.

2003 Topps Chrome LeBron James base rookie card. Image via eBay. Shop this card on eBay.

If you’re something of a risk taker, you might also consider investing long-term in younger, unproven talent. Are you confident Luka will become an all-time great? Then you might want to hold on that numbered rookie parallel for just a little longer.

Shop LeBron James cards on eBay

And that segues us quite nicely into our first short-term strategy…

Short-term strategies:

• Prospecting

Prospecting involves investing in younger players with star potential while their cards are still (relatively) undervalued. Right now, this includes guys like Victor Wembanyama, Anthony Edwards, Shai Gilgeous-Alexander, Tyrese Haliburton and many, many more. As a fan, this can add a whole new level of excitement when cheering on your favorite players and teams, too.

Anthony Edwards 2020-21 Prizm (Silver) rookie card. Image via SportsCardInvestor. Shop this card on eBay.

Of course, this strategy runs the risk of players not panning out the way we expect or hope. Remember when Brandon Jennings dropped 55 points in 2009 and everyone thought he’d be the next great point guard? Or how about when Tyreke Evans took home Rookie of the Year honours that same year? Both dudes are now out of the league in their early 30’s. The NBA is a brutal business, and no one — not even professional scouts or advanced statistical models — can confidently predict a player’s career trajectory.

Note that there’s a reason prospecting is categorized under short-term strategies: even if a player does pan out and see a spike in value, there’s no guarantee that those cards will hold or grow in value long-term. If the past is any indication, even many All-Star level players in today’s league will fade away into relative obscurity decades after they retire, and you’ll be left wondering why you didn’t flip them at the peak of their hype during their playing careers. To re-iterate, then, long-term, set-it-and-forget-it investing should be reserved for the hobby GOATS mentioned in the previous section — or, if you wanna gamble, prospects who you think have a chance to get there.

• Flipping based on market trends, hype and events

This strategy is similar to prospecting but generally involves hedging your bets on well-established players.

For example, it could entail stocking up on a star player’s cards during the offseason and selling when he carries his team deep into the playoffs next season, knowing that prices tend to go up in the post-season.

It could involve buying the dip when a player gets injured in the hopes that he’ll come back stronger than ever.

It could also involve forecasting awards, championships and other events (e.g. Hall of Fame induction) well in advance. Were you on the Nuggets championship hype train way earlier than everyone else? If so, you could’ve made a lot of money on Jokic cards.

Nikola Jokic 2015-16 Prizm base rookie card price chart; notice the spike in value around the time the Nuggets took home the championship and Jokic won Finals MVP. Image via SportsCardPro. Shop Nikola Jokic rookie cards on eBay.

Short-term and long-term investing strategies can be synergistic, too. Because not everyone can afford to dole out hundreds of thousands on GOAT rookie cards, flipping and prospecting can be fun ways to slowly roll up your investment towards more valuable cards.

Buying & Selling Basketball Cards

Alright, so you’ve figured out your strategy and you’re looking to buy some singles. Where do you look?

In-person

If you’re lucky enough to have a local card shop (LCS) in your area, that’s a fantastic place to start. Aside from supporting local businesses, frequenting your LCS is a great way to meet fellow hobbyists and maybe even strike some nice deals after you’ve built up rapport with the shop owners. Another way to deal cards in person is at card shows. These events are a great opportunity to move a lot of inventory and get some great deals (it’s common practice to sell cards cheaper in face-to-face transactions relative to online transactions due to the lack of fees and shipping costs associated with online marketplaces) — all while having a good time with fellow hobbyists.

Online marketplaces and retailers

With regards to online marketplaces, eBay is far and away your best bet. Aside from being easily the largest marketplace for sports cards in the world, eBay is a trusted platform with reliable buyer protection (this is especially true now with the advent of eBay PSA Vault, a physical storage facility that enables customers to authenticate graded cards when buying and selling). Here’s a great video on how to scope out great deals on eBay and here’s one on best practices for packaging and shipping cards.

Two platforms that make it incredibly convenient to flip cards are COMC and StarStock. As a seller, both sites act as consignment services that will list your cards for a small fee. When you buy a card, you have the option to immediately re-list the card for sale (or keep it stored in your inventory until you wish to list it), cutting out the time and hassle of waiting for your delivery, creating your own item listing and shipping out your card. Of course, you also have the option to have your cards shipped to you whenever you’d like.

There’s also Whatnot, a relatively new app-based marketplace that specializes in quick, live auctions. While it’s definitely possible to snatch some amazing deals if you’re lucky enough to pop into a stream that isn’t too busy, it’s also very easy to get sucked into box breaks or spur-of-the-moment FOMO bids. I’d approach this one with caution.

Another good option is Alt. Alt’s mission is to make alternative asset investing as transparent and liquid as stock trading. By signing up for their “exchange”, you can purchase cards from their vault and track your portfolio value in real time — something that no other service provides. As a seller, they also offer the lowest fees of any service. Oh, they were also the guys who purchased that Steph Logoman for $5.9 million, by the way.

The downside of selling on all of these sites, however, are the fees. For example, in addition to COMC’s $0.50 per card listing fee and 5% cut of every sale, they also slice off a whopping 10% every time you decide to cash out your money. If the idea of pesky fees eating away at your profit margins irks you, you can try social media instead: both Instagram and Facebook have bustling marketplaces for sports cards. Be wary of scammers, though, and always pay using PayPal Goods & Services for buyer protection.

For super high-end graded cards, you can check out consignment auction sites like PWCC (now Fanatics Collect) and Goldin Auctions.

Finally, if you’d prefer to get sealed product straight from the manufacturer or reputable retailers, you can purchase from Panini’s official website or retailers like Dave & Adam's Card World or Blowout Cards.

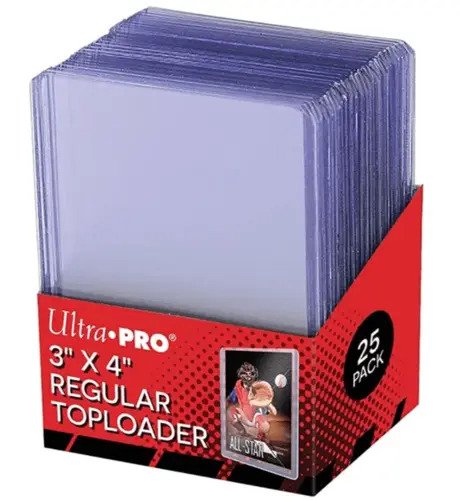

Basketball Card Supplies

Condition is the name of the card game. This means that before you even think about buying cards, you need to stock up on the proper supplies — both for personal storage and to ensure that your cards will be shipped safely when you decide to sell.

Before we get into these supplies, it should be noted that basketball cards come in varying thicknesses, with higher-end cards typically being thicker. The unit of measurement for card thickness is a “point”; 1,000 points equal one inch. Keep that in mind when buying the supplies listed below.

• Penny sleeves

Ultra Pro penny sleeves. Image via Amazon.

Penny sleeves are thin, transparent plastic sleeves that serve to protect your cards from surface damage. They’re pretty cheap, especially if you buy them in bulk, so there’s no reason why any semi-valuable card shouldn’t go straight into one of these.

Shop penny sleeves on Amazon here

• Toploaders

Ultra Pro top loaders. Image via Amazon.

Toploaders are semi-rigid plastic cases that protect your cards from bending, creasing and corner/edge wear. Valuable cards should, at the very least, be sleeved and stored in a toploader.

Shop toploaders on Amazon here

• Magnet (One-Touch) Storage Case

Ultra Pro One-Touch magnetic cases. Image via Amazon.

For higher-end cards, one-touch cases are a pricey but worthwhile investment. These rigid plastic containers snap your card into place, ensuring maximum protection against bending, creasing, corner/edge wear and even UV light.

Shop one-touch cases on Amazon here

• Semi-rigid card savers

Cardboard Gold Card Saver I’s. Image via Amazon.

Card savers are a cheaper alternative to toploaders for protecting your cards. Though significantly flimsier than toploaders, they offer the benefit of being able to hold many sleeved cards at once, making them a profit margin-friendly option when selling and shipping multiple lower value cards. Most importantly, they’re also required by PSA when submitting your raw cards for grading.

Shop card savers on Amazon here

• Cardboard storage boxes

Cardboard card storage box. Image via Amazon.

The inescapable reality of ripping boxes is that you’re going to be swamped with a lot of bulk (i.e. low value cards). These cardboard boxes are the perfect solution for storing bulk and toploaded cards.

Shop cardboard storage boxes on Amazon here

• Graded card case

CASEMATIX graded card case. Image via Amazon.

Card binder. Image via Amazon.

Though not a necessity for pure investors stockpiling only valuable cards, no true hobbyist is complete without a binder to showcase their precious collection.

Shop binders on Amazon here

Grading Basketball Cards

Should you get your card graded?

If it’s rare, highly sought-after and in mint to near mint condition, the answer is a resounding yes.

If it’s one or two of those qualifiers, it’s probably still a yes. Case in point: when Victor Wembanyama’s first NBA rookie cards dropped in 2023, his base cards and unnumbered parallels weren’t particularly rare, but their demand at the time was so high that highly-graded copies still substantially increased their value over their raw counterparts. Conversely, a 1986 Fleer Michael Jordan is so highly sought-after that even a poorly graded copy will fetch over $1,000.

If it meets none of those qualifiers, you’d likely actually lose money on the grading fee. PSA currently charges from $25 per card for low-value cards all the way up to $7,999 per card for cards worth over $250,000.

It should also be noted that turnaround times for grading can be long for non-express services. This is important to keep in mind if you’re looking to sell within a certain timeframe. For example, let’s say you buy a card in March that you’re looking to flip by the time the playoffs end because you think the player will win the championship that year (and, as a result, experience a value spike). To ensure that it gets back to you in time, you’d need to pay for PSA’s Regular or Express service, which currently costs $75 and $129, respectively. Will your profit margin be large enough to make that worthwhile? Maybe you’ve decided that it will be — as long as you strike a 10. But 10s are fairly tough to come by, even for cards pulled straight from a pack and immediately tucked away inside a toploader or one-touch case. Are you willing to take that risk?

If you are, make sure that your card is up to par on these four criteria: corners, edges, surfaces, centering. Here’s a detailed overview of PSA’s grading standards.

Frequently Asked Questions (FAQs) About Investing in Basketball Cards

How do I invest in basketball cards?

Like any investment, the key to investing in basketball cards is to buy low and sell high. To do this, start by researching the market and current trends (SportsCardPro and Market Movers are good places to start). Decide on a strategy (e.g., long-term holding or short-term flipping) and budget. Focus on cards of players you believe will increase in value. Purchase cards from reputable sources, properly store and protect them, and stay informed about the market and player performances. Consider factors like card rarity, player popularity, and card condition when making purchases.

Are basketball cards a good investment?

Basketball cards are a solid alternative asset class with proven longevity. Since the first releases in 1948, basketball cards have continued to grow in popularity with no signs of slowing down; according to Yahoo! Finance, the global trading card market is projected to balloon to $27.5 billion by 2033.

In accordance with this growing popularity and market size, highly-collectible basketball cards have experienced consistent and reliable appreciation over the decades. For example, the iconic 1986 Fleer Michael Jordan rookie card in a PSA 10 was valued at around $7,000 in 2004, but last sold in 2023 for $217,295 — that’s an annualized return of 19.82%! For comparison, the S&P 500 saw an annualized return of “only” around 9% in the same time frame. As long as public interest in basketball cards and collectibles continues to grow, it is relatively safe to assume that high-value basketball cards will continue to appreciate over time.

The key word, of course, is relatively. Like any investment, there are risks involved. The market can be volatile (see the pandemic bubble of 2020-2021), and not every card will increase in value. It's important to do thorough research and only invest what you can afford to lose. All things considered, basketball cards can be a profitable and safe investment (as far as alternative assets go), but it requires knowledge, strategy, and some luck.

Where do I buy and sell basketball cards?

There are several options for buying and selling basketball cards:

Online marketplaces: eBay, COMC, StarStock, and Whatnot are popular platforms.

Local card shops (LCS): Great for in-person transactions and building relationships.

Card shows: Excellent for face-to-face deals and networking.

Social media: Facebook groups and Instagram can be good for direct sales.

Auction houses: For high-end cards, consider sites like PWCC and Goldin Auctions.

Online retailers: Sites like Dave & Adam's Card World or Blowout Cards for buying new sealed product. Alternatively, you can go straight to the source and purchase from Panini’s website; just keep in mind that product sells out fast there.

What's the best basketball card to invest in?

There's no single "best" card, as it depends on your budget and strategy. However, rookie cards of established superstars like Michael Jordan, LeBron James, and Kobe Bryant are generally considered safe long-term investments. For shorter-term investments, cards of rising stars or players you believe will improve significantly can be good options.

Should I buy graded or raw basketball cards?

For valuable cards, graded is often preferable as it provides authentication and a professional assessment of the card's condition. However, buying raw cards and getting them graded yourself can sometimes lead to higher profits if you're skilled at assessing card condition.

How do I know if a basketball card is worth grading?

Consider grading if the card is rare, in high demand, and in excellent condition. Also, calculate if the potential increase in value outweighs the grading costs. For modern cards, generally only grade if you believe it has a good chance of receiving a high grade (9 or 10).

Is it better to buy individual cards or sealed boxes?

Both have their merits. Buying individual cards allows you to target specific players or rare cards. Sealed boxes can be good for long-term holding as they tend to reliably appreciate over time, but opening them is generally not profitable in the short term.

How often should I buy or sell cards?

This depends on your strategy. Long-term investors might hold cards for years, while short-term investors might buy and sell based on player performance or market trends. It's important to have a clear strategy and not make impulsive decisions based on short-term market fluctuations.

How do I protect my card investments?

Store cards properly using penny sleeves, toploaders, or one-touch cases. Keep them in a cool, dry place away from direct sunlight. For very valuable cards, consider professional storage solutions or a safety deposit box.

Are digital basketball cards (like NBA Top Shot) worth investing in?

Digital collectibles are a growing market, but they're still relatively new and their long-term value is uncertain. They can be part of a diversified collecting strategy, but approach with caution and do thorough research.

How do I spot fake or counterfeit cards?

Familiarize yourself with the characteristics of authentic cards, including print quality, card stock, and security features. Buying graded cards from reputable grading companies can help avoid counterfeits. When buying raw cards, purchase from trusted sellers and retailer, and be wary of deals that seem too good to be true.

What's the best way to stay informed about the basketball card market?

Follow reputable card investing websites and social media accounts, join online forums or local card collecting groups, and stay up-to-date with basketball news and player performances.

Conclusion & useful links

And there you have it — everything you need to know to get started with basketball card investing. Have comments or questions? Feel free to drop them in the comment section or below or get in touch with me via email!

This probably goes without saying, but I am not a financial advisor and this is not financial advice. Invest only what you can afford to lose. Collect only what you want to collect. And most importantly, have fun doing it!

To keep up to date with new content I put out, make sure to subscribe to my email newsletter!

If you found this article useful at all, I would be extremely grateful if you would consider dropping me a tip here.

Here are some useful links to help you delve deeper into the hobby:

TRIKE415SportsCards (YouTube channel)

Featured image (“#20-BASKETBALL SPORTS CARD LOT” by supportcaringllc) is licensed under CC BY-SA 2.0. No changes were made.

The Luka Doncic 2018-19 National Treasures Logoman RPA 1/1 is one of the most valuable basketball cards of all time. Find out how one genius investor made $1 million off of it — and still owns the card!